In a bold strategic pivot, Farcaster co-founders Dan Romero and Varun Srinivasan have joined Tempo, a stablecoin-centric startup incubated by Stripe and Paradigm. This move comes months after Neynar acquired Farcaster in January 2026, effectively closing the chapter on the founders’ direct leadership of the decentralized social protocol. As Farcaster founders Tempo headlines dominate crypto discourse, their exit underscores a broader recalibration in Web3 priorities, shifting from social experimentation to scalable payments infrastructure.

The decision reflects mounting pressures in decentralized social media. Farcaster, once a beacon for onchain social with its frames and warpcast app, struggled to achieve viral escape velocity amid competition from Lens Protocol and centralized giants. Neynar’s acquisition provided liquidity and continuity, allowing Romero and Srinivasan to redirect energies toward Tempo’s mission: building global payments rails powered by stablecoins. This isn’t abandonment; it’s tactical repositioning in a market where social traction proves fleeting, but payments demand endures.

Farcaster’s Rise, Challenges, and Handover to Neynar

Farcaster launched in 2020 under Merkle Labs, the entity founded by Romero and Srinivasan, positioning itself as a user-owned social graph on Optimism. Its innovation lay in separating storage from computation, enabling portable identities and novel apps like frames that embed interactivity directly in feeds. Peak metrics showed over 500,000 active users, but retention lagged as monetization models faltered. Developer activity surged in 2025, yet sustainable revenue eluded the protocol.

Enter Neynar’s January 2026 buyout. The infrastructure firm, already powering much of Farcaster’s API layer, absorbed Merkle Labs’ team and tech. Sources like CoinDesk and Bankless frame this as stabilization rather than disruption. Post-acquisition, Farcaster’s daily active users stabilized around 200,000, per onchain data, but growth stalled against Bluesky and Threads. Romero and Srinivasan stepped back, citing a desire to tackle “payments at global scale. ” This Varun Srinivasan Farcaster exit aligns with their quantitative backgrounds; Srinivasan engineered Farcaster’s Hframes, while Romero championed product vision.

Tempo’s Ambitious Stablecoin Vision and Backing

Tempo emerges as a Layer 1 blockchain optimized for stablecoin transactions, targeting cross-border inefficiencies that plague traditional finance. Incubated by Stripe, which revealed stablecoin ambitions in 2025, and backed by Paradigm, Tempo boasts nine-figure funding from inception. Its thesis: stablecoins like USDC and USDT already move $10 trillion annually onchain, yet settlement speeds and costs hinder mainstream adoption. Tempo aims to fix this with sub-second finality and native yield mechanisms.

Romero joins as head of product, Srinivasan as engineering lead, per announcements aggregated on Unchained and DL News. Their Farcaster pedigree brings social expertise to payments UX, potentially embedding social features into remittances or merchant payouts. Paradigm’s involvement signals conviction; the VC firm’s portfolio includes Basis and Frame, early stablecoin bets. In a landscape where Tether dominates 70% market share, Tempo positions as an institutional-grade alternative, compliant from day one.

Unpacking the Reasons for the Decentralized Social Shift

Several data points explain this Farcaster Neynar acquisition aftermath pivot. First, user economics: Farcaster’s powerbadge system rewarded engagement, but sequencer revenue never exceeded $5 million quarterly, per Dune Analytics. Social protocols face zero-marginal-cost dynamics, commoditizing attention without proprietary moats. Lens Protocol, by contrast, monetizes via profiles but grapples with similar retention issues.

Strategic Shift to Tempo Factors

-

Payments market 100x social: Global payments sector vastly outpaces social media by over 100x in market size.

-

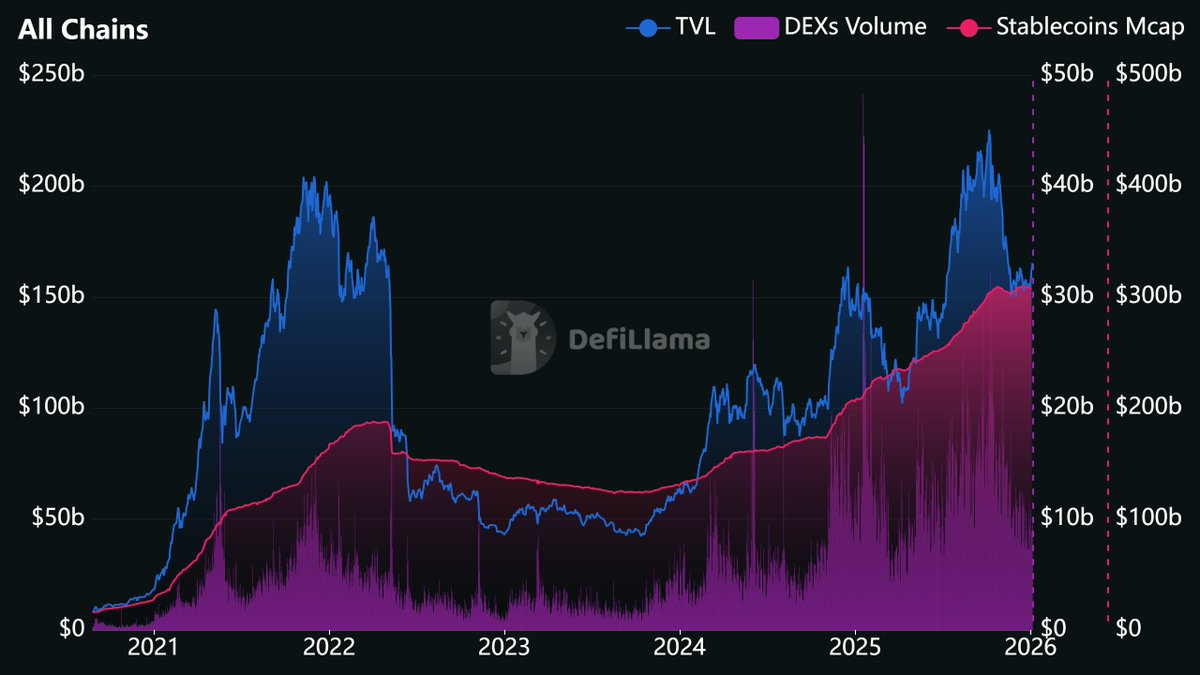

Stablecoin TVL at $200B in 2026: Surging total value locked signals massive payments opportunity.

-

Farcaster maturity post-Neynar: Acquisition by Neynar in Jan 2026 enables protocol independence.

-

Founders’ fintech alignment: Romero and Srinivasan pivot to stablecoin payments expertise.

-

Stripe-Paradigm firepower: Tempo backed by Stripe incubation and Paradigm for global scale.

Second, competitive intensity. With X reentering crypto via payments and Telegram’s TON exploding, pure social plays risk obsolescence. Romero’s public posts hinted at frustration with “social as a commodity. ” Third, opportunity cost: stablecoins power 15% of global remittances already, projected to 50% by 2030 per BCG. Tempo’s focus on programmable money resonates with the founders’ builder ethos.

This transition spotlights Web3’s maturation. Decentralized social protocols like Farcaster proved composability works, but scaling user bases demands hybrid models. Neynar inherits a battle-tested stack; Romero and Srinivasan chase trillion-dollar flows. Investors take note: decentralized social protocols evolve, but payments infrastructure captures enduring value.

From a trader’s lens, this Farcaster Neynar acquisition creates asymmetric opportunities. Neynar’s control could unlock Farcaster’s latent value through API monetization or frame-based DeFi integrations, stabilizing DAUs at 200,000 while protocol revenue climbs via sequencer fees. Yet the real alpha lies in Tempo’s stablecoin rails. With global remittances topping $800 billion yearly and stablecoins capturing 15% already, per BCG estimates, Tempo’s sub-second settlements position it to siphon flows from SWIFT’s $150 trillion annual volume. Romero’s product instincts and Srinivasan’s engineering rigor could compress UX gaps, driving adoption spikes.

Farcaster Under Neynar: Stability or Stagnation?

Neynar’s stewardship shifts Farcaster toward enterprise-grade tooling. The acquirer’s EmbedKit and API dominance already funnels 80% of protocol traffic, per onchain dashboards. Expect refinements like improved powerbadges for creator economies and cross-protocol bridges to Lens, addressing Farcaster wallet pivot 2026 rumors by enhancing onramping. Metrics post-acquisition show 10% MoM growth in frames deployed, hinting at developer stickiness. But without founder charisma, Warpcast risks fading against Friend. tech’s gamified hooks or Bluesky’s federation push. Neynar must prove it can rally the 100,000 and node operators to sustain Optimism L2 sequencing.

The protocol’s handover mirrors early crypto patterns: Bitcoin Core developers pivoting to Lightning, Ethereum founders chasing L2 scaling. Farcaster’s social graph endures as public infrastructure, composable for whatever comes next – perhaps AI agents or tokenized attention markets. Developers should eye Neynar grants; the stack remains unmatched for portable identities.

Tempo’s Edge in the Stablecoin Wars

Dan Romero Tempo and Varun Srinivasan Farcaster exit inject battle-tested talent into a frothy sector. Tether’s $120 billion circulation dwarfs rivals, but regulatory scrutiny and opacity erode trust. USDC’s $50 billion lags on yieldless design. Tempo differentiates with native programmability: think stablecoins that auto-yield or escrow via smart contracts, tailored for Stripe’s merchant stack. Paradigm’s backing, alongside a16z crypto’s stablecoin portfolio, forecasts $500 million Series A potential by Q3 2026.

Quantitative angles favor this bet. Stablecoin transfer volumes surged 300% YoY to $10 trillion, outpacing DeFi TVL growth. Volatility in pairs like USDT/USD hovers at 0.1% daily – tight enough for rails, wide for arb opportunities. As an options strategist, I model Tempo capturing 5% of cross-border flows by 2028, implying $40 billion throughput. Founders’ social chops enable viral loops: imagine frames for instant P2P sends, blending Farcaster’s interactivity with payments.

Challenges loom. Circle’s dominance via Coinbase integrations and PayPal’s PYUSD push test Tempo’s moat. Regulatory tailwinds help – U. S. stablecoin bills eye 2026 passage – but execution risks persist. Romero’s track record tempers doubts; Farcaster bootstrapped to 500,000 users sans VC hype. Srinivasan’s Hframes optimized for 1,000 TPS; scaling to payments demands 10x that.

This pivot redefines Web3 ambition. Tempo stablecoin Farcaster ties expose social’s role as payments frontend. Traders, position for volatility: Neynar tokens if spun out, Tempo airdrops for early users. Protocols mature when builders chase scale over novelty. Romero and Srinivasan grasp this – payments aren’t flashy, but they print money. In crypto’s next phase, rails trump feeds every time.