In the ever-shifting sands of Web3 social protocols, the Neynar Farcaster acquisition in January 2026 stands as a pivotal moment. Neynar, a venture-backed infrastructure powerhouse, absorbed Farcaster’s core assets, prompting co-founders Dan Romero and Varun Srinivasan to exit daily operations. This move, coupled with Merkle Manufactory’s decision to return the full $180M VC return to investors like a16z Crypto and Paradigm, has ignited fierce debates: Is this a graceful reset for decentralized social, or a signal of deeper troubles ahead for platforms like Warpcast?

Unpacking the Neynar Takeover Mechanics

Neynar’s acquisition wasn’t a fire sale but a calculated handoff. It encompassed Farcaster’s protocol smart contracts, GitHub repositories, the flagship mobile app, and Clanker, an AI-driven token launchpad. By January 29,2026, Neynar assumed stewardship, vowing to pivot the ecosystem toward a wallet-first approach. This shift prioritizes seamless on-chain interactions over pure social feeds, aiming to boost utility amid stagnant user metrics.

Context matters here. Farcaster entered 2025 with 250,000 monthly active users and over 100,000 funded wallets as of December. Yet, reports highlighted declining engagement, framing the deal as a response to “fading billion-dollar dreams. ” Neynar, already a key client providing API and indexing services, steps in as a natural successor, leveraging its infrastructure expertise to sustain the protocol without shutting it down.

Romero emphasized this was “five years in the making, ” quelling shutdown fears while signaling a strategic pivot.

Founders’ Exit: A $180M Lesson in Discipline

Dan Romero and Varun Srinivasan’s departure marks a rare full capital return in crypto’s high-burn startup culture. Merkle Manufactory, Farcaster’s parent, opted to refund every dollar of its $180 million raise, a move Romero described as deliberate after years of bootstrapping revenue through services. This Farcaster founders exit underscores fiscal prudence: generate cash flow, avoid dilution, and exit on your terms.

Analytically, it’s a masterclass in capital stewardship. Traditional VCs often chase moonshots; here, founders delivered liquidity without a token pump or acquisition premium. Investors recoup principal intact, freeing a16z and Paradigm for fresher bets. For Web3 builders, it poses a stark question: In a bearish social meta, is returning capital savvier than grinding toward unicorn status?

Immediate Ripples for Warpcast Builders

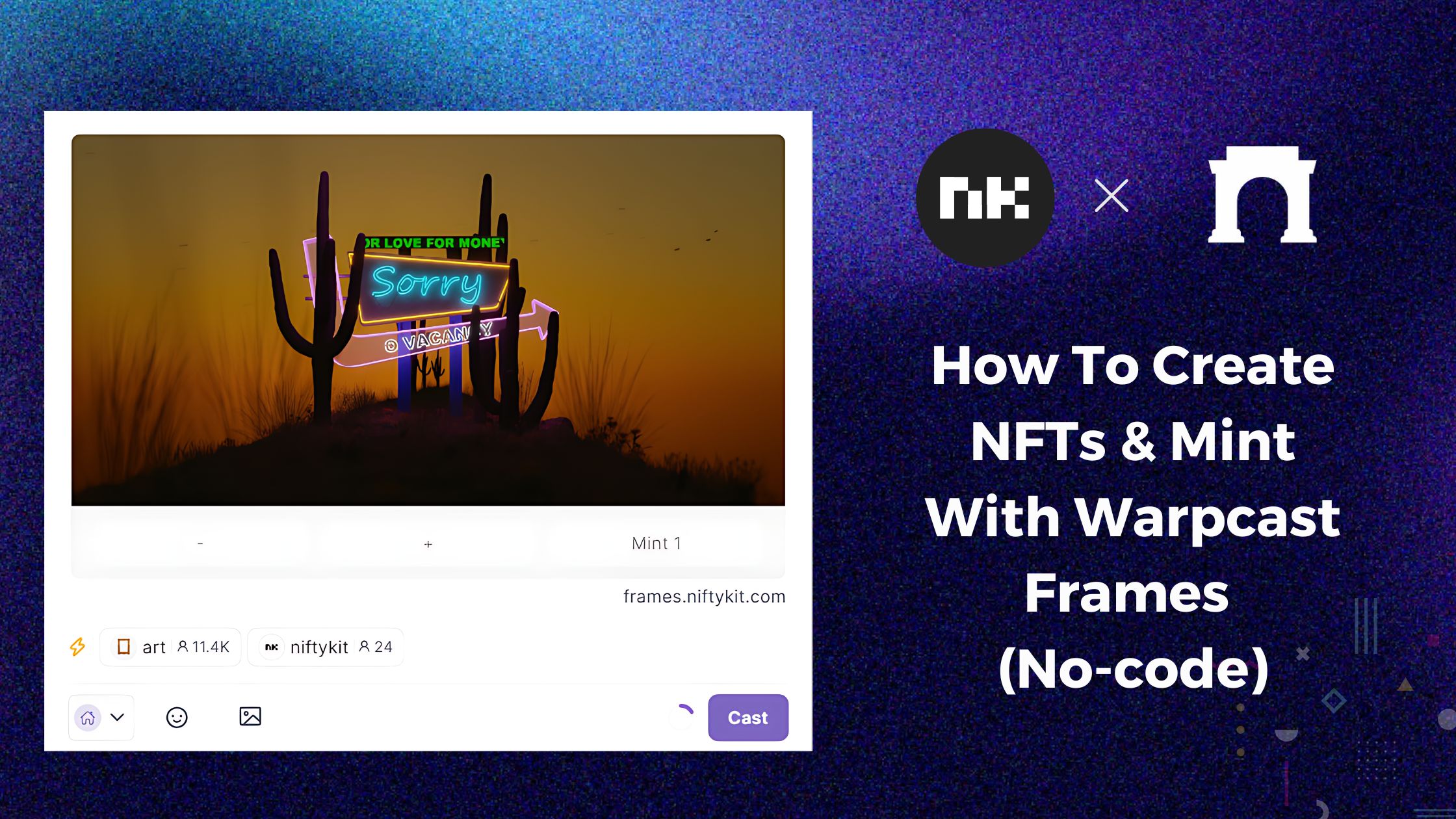

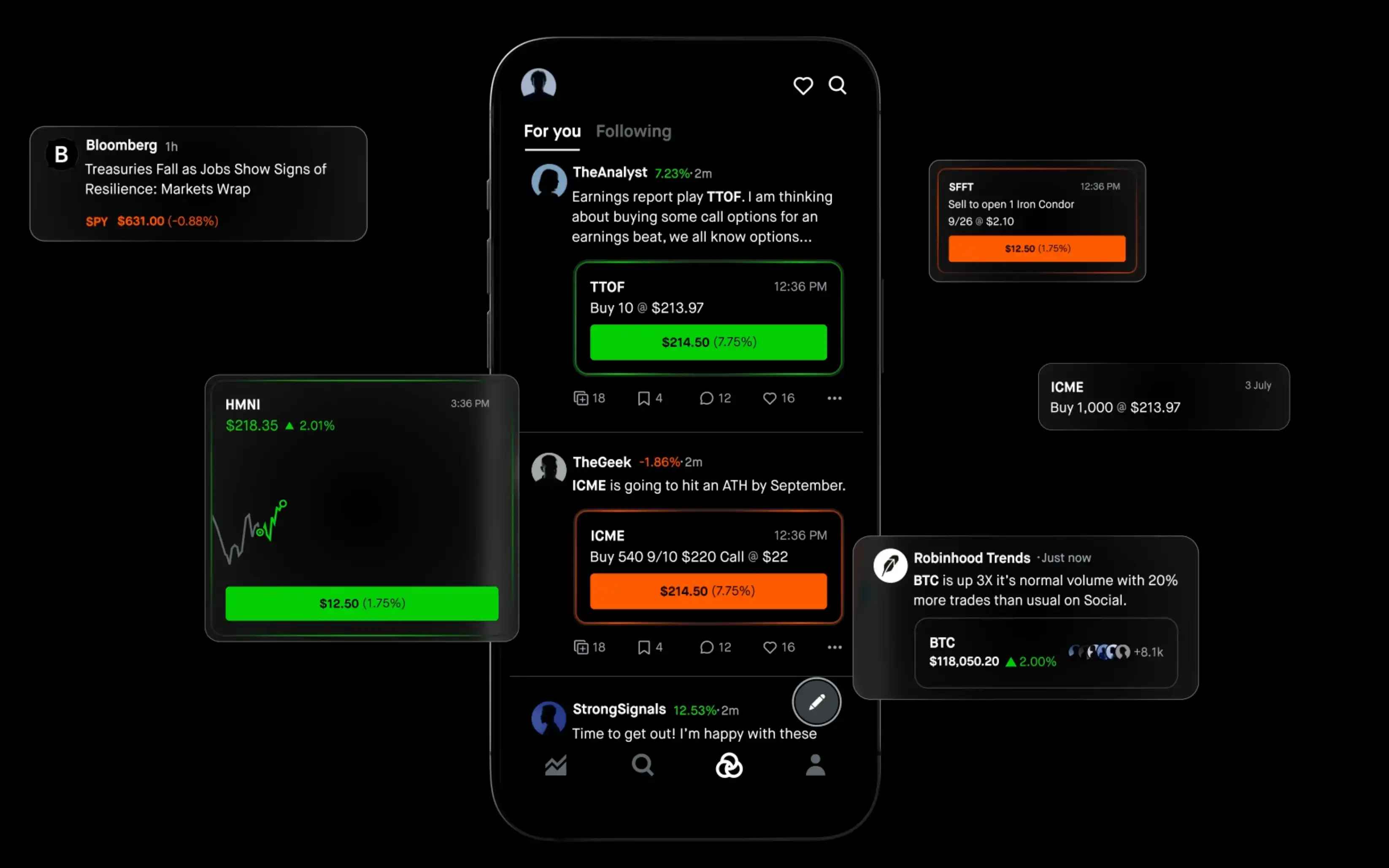

Warpcast, Farcaster’s dominant client app, now navigates uncharted waters under Neynar’s developer-centric vision. Builders reliant on Farcaster’s frames, casts, and hubs face both opportunity and uncertainty. Neynar’s wallet-first push could supercharge on-ramps, embedding token swaps and DeFi directly into feeds, potentially revitalizing the Warpcast Neynar future.

Yet, the transition isn’t seamless. With founders stepping back to chase new ventures, institutional knowledge walks out the door. Early signals suggest Neynar will open-source more tools, courting third-party clients to diversify beyond Warpcast dominance. Metrics will tell: Can monthly actives rebound from 2025 lows, or does this herald a fragmented decentralized social Neynar 2026 landscape?

Zooming out, this saga reflects Web3 social’s maturation pains. Protocols like Farcaster promised Twitter killers; reality delivered niche communities with monetization hurdles. Neynar’s infrastructure muscle might stabilize the base layer, but sustained growth hinges on builder incentives and viral hooks that eluded the original team.

Builders on Warpcast must adapt swiftly to Neynar’s blueprint. The wallet-first approach promises embedded DeFi primitives, like frictionless token launches via Clanker, directly challenging Supercast and Superframes’ limitations. Neynar’s control over core repos enables faster iteration, potentially rolling out EIP-7702 compatibility for account abstraction sooner than rivals.

Strategic Opportunities for Warpcast Ecosystem

Neynar’s stewardship injects fresh capital and expertise, absent in Farcaster’s founder-led era. With 100,000 and funded wallets providing a solid base, the protocol eyes interoperability with Layer 2s like Base and Optimism. This could manifest in cross-chain casts, where Warpcast users bridge assets seamlessly, elevating Warpcast Neynar future from social novelty to financial hub.

Pros & Cons for Warpcast Builders

-

Enhanced Developer Tools: Neynar’s infrastructure APIs and services boost frame building and app development on Farcaster.

-

Wallet-First Integrations: Strategic shift enables deeper Warpcast wallet features for better user utility and engagement.

-

Long-Term Stewardship: Neynar’s commitment ensures protocol stability post-acquisition, supporting ongoing builds.

-

Transition Disruptions: Handover of contracts, repos, and Warpcast app risks short-term API or feature instability.

-

Founder Knowledge Gap: Dan Romero and Varun Srinivasan’s exit leaves void in original protocol vision and nuances.

-

Direction Uncertainty: Pivot from social-first to developer/wallet focus may challenge existing Warpcast-centric apps.

Yet risks loom. Neynar’s VC roots might prioritize enterprise APIs over grassroots innovation, alienating solo devs who fueled Farcaster’s early frames boom. User activity dipped in late 2025, per Binance reports, underscoring the need for viral mechanics like gamified power badges or AI-curated feeds to reclaim momentum.

Web3 Social’s Broader Reckoning

This Neynar Farcaster acquisition mirrors Lens Protocol’s stumbles and Friend. tech’s fade, exposing decentralized social’s core tension: ownership without retention. Farcaster’s 250,000 MAUs pales against centralized giants, yet its open protocol endures where closed apps crumble. Neynar’s bet on developers over users flips the script, betting infrastructure wins wars while apps fight battles.

Opinionated take: Founders’ exit is no failure but a blueprint for sustainability. Returning $180M intact sidesteps token dumps that plague rivals, preserving reputations for Romero and Srinivasan’s next acts, rumored in wallet primitives. For VCs, it’s a clean reset; a16z reallocates to hotter metas like intent-based social. Warpcast builders thrive by leaning into Neynar’s tools, forking repos if needed, and building hybrid social-finance apps that monetize via fees, not airdrops.

Neynar’s pivot signals decentralized social Neynar 2026 maturity: protocols as utilities, not unicorns.

Forward-looking, expect Warpcast forks and Neynar-backed clients to fragment the space healthily, much like Ethereum’s L2 boom. Metrics to watch: DAU growth post-Q1 2026, frame adoption rates, and Clanker launch velocity. If Neynar delivers 2x wallet funding in six months, skeptics quiet; otherwise, Web3 social risks relegation to crypto’s periphery.

The $180M return cements Farcaster’s legacy as disciplined outlier. In a sector rife with overpromises, this handoff to capable stewards offers Warpcast builders a stable runway. Success demands execution: Neynar must court devs with grants, Warpcast with UX overhauls. The protocol lives, evolved, ready for its next cast into the decentralized horizon.