In a move that underscores the maturing dynamics of decentralized social networks, Merkle Manufactory has sold Farcaster to Neynar while committing to return the full $180M raised from venture capitalists. This Farcaster Neynar acquisition, announced in January 2026, isn’t a shutdown but a pivot, with co-founder Dan Romero affirming the protocol’s continuity amid 250,000 monthly active users and over 100,000 funded wallets. For investors eyeing the long-term trajectory of Web3 social, this signals a structural reset rather than retreat.

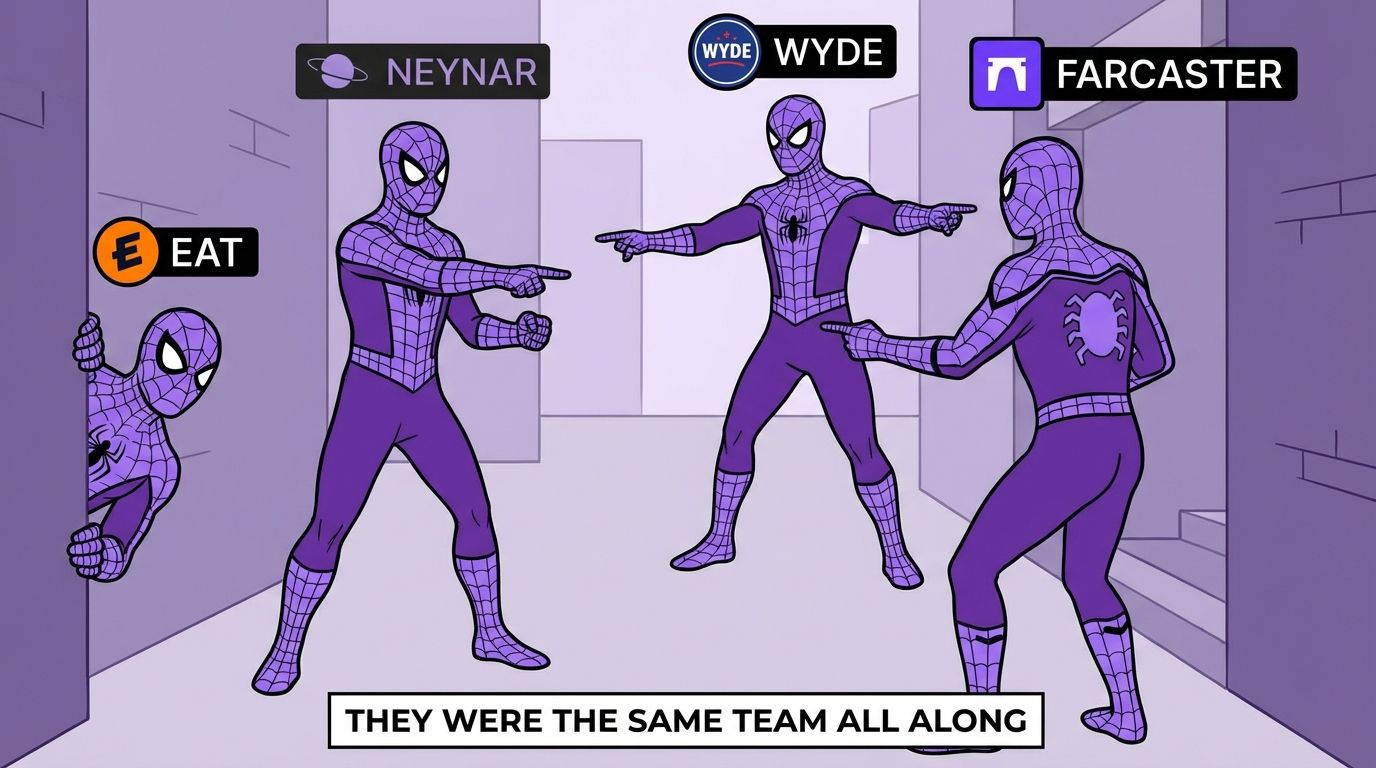

Decentralized social protocols like Farcaster have long promised user-owned data and censorship resistance, yet they’ve grappled with sustainable economics. Warpcast, Farcaster’s flagship client, drew hype post its 2022 seed round led by a16z. But as growth stabilized, founders chose liquidity over endless fundraising. Neynar, already deep in decentralized social infrastructure, steps in to steer Farcaster toward developer tools and scalability. This Farcaster Neynar acquisition could redefine how protocols evolve beyond hype cycles.

Unraveling the Deal Mechanics

Merkle Manufactory, the R and amp;D entity behind Farcaster, raised $180M over five years from top-tier VCs including Paradigm and a16z. Rather than burn through it in pursuit of unicorn status, they’re refunding every dollar. Dan Romero, ex-Coinbase VP, quelled shutdown fears on social channels, emphasizing operational health. Neynar’s takeover shifts focus: expect enhanced APIs, better hub infrastructure, and incentives for client diversity beyond Warpcast.

This isn’t fire-sale desperation. Farcaster’s 250,000 monthly active users and robust wallet adoption reflect real traction. Neynar, venture-backed itself, brings expertise in protocol tooling. The acquisition consolidates a fragmented sector, where pure social apps yield to infrastructure plays. For context on Farcaster’s funding roots, see the earlier Paradigm and a16z commitment.

VC Return as Strategic Discipline

Returning $180M to investors marks rare founder discipline in crypto. Most protocols dilute endlessly, chasing metrics over product-market fit. Merkle’s move echoes early Bitcoin ethos: build antifragile systems, not VC-fueled moonshots. Romero noted the protocol’s self-sustainability, with frames and casts driving organic engagement. This Farcaster $180M return frees founders for new ventures while handing a battle-tested protocol to Neynar.

Critics might see it as ambition fade, but fundamentals suggest otherwise. Decentralized social thrives on composability, not centralized growth hacks. Neynar’s vision aligns: prioritize devs building on Farcaster, from custom clients to NFT-gated communities. With Lens Protocol facing similar scalability tests, this decentralized social acquisition sets a blueprint for 2026 transitions.

Farcaster’s Path Under Neynar Ownership

Post-acquisition, Farcaster won’t miss a beat. Romero highlighted over 100,000 funded wallets, a proxy for committed users. Neynar plans infrastructure upgrades, targeting hub decentralization and query efficiency. This developer tilt could spark a client renaissance, diluting Warpcast dominance and fostering innovation. In a landscape crowded by Friend. tech clones and fleeting Telegram minis, Farcaster’s pivot reinforces its protocol-first DNA.

Expect Neynar to accelerate Farcaster’s evolution into a robust backbone for Web3 social applications. Enhanced developer tools could unlock use cases like tokenized communities and AI-driven content curation, areas where centralized platforms falter. This Neynar Farcaster takeover positions the protocol for sustained relevance, sidestepping the pitfalls of user acquisition arms races.

Investment Signals from the $180M Return

For those building portfolios in decentralized social, Merkle’s refund sends clear signals. First, it validates protocol maturity: Farcaster achieved product-market validation without perpetual dilution. Second, it highlights investor discipline, a rarity in crypto where 90% of VC-backed projects vanish. Paradigm and a16z, early backers, recoup fully, preserving dry powder for proven bets. This Farcaster $180M return resets expectations, favoring fundamentals over froth.

Key Investment Implications

-

1. Protocol handoff to infrastructure specialists: Farcaster transitions from Merkle Manufactory to Neynar, a specialist in decentralized social infrastructure, ensuring sustained technical advancement.

-

2. VC capital efficiency model: Merkle Manufactory plans to return $180M fully to venture backers like a16z, demonstrating a novel refund model post-sale.

-

3. Developer ecosystem boost: Neynar shifts Farcaster toward developer-focused tools, leveraging 250,000 MAU and 100,000 funded wallets for enhanced scalability.

-

4. Reduced dilution risk for future tokens: Full VC repayment minimizes equity overhang, lowering dilution risks for potential Farcaster or Neynar tokens.

-

5. Blueprint for Lens and similar protocols: Sets precedent for protocols like Lens Protocol, favoring infrastructure handoffs amid sector consolidation.

Consider Lens Protocol, Farcaster’s closest rival. Lens boasts larger creator economies but centralized bottlenecks in profile management. Farcaster’s leaner stack, now supercharged by Neynar, offers superior composability. As regulatory scrutiny intensifies on data ownership, protocols with provable decentralization command premiums. Investors should watch Neynar’s first roadmap: hub upgrades could double query speeds, drawing dApp builders en masse.

Broader Ripples in Decentralized Social

This acquisition ripples across the sector. Friend. tech’s spectacle faded; pump. fun minis prove ephemeral. True staying power lies in open protocols like Farcaster, where users own identities via frames and casts. Neynar’s focus counters centralization creep, ensuring no single client like Warpcast bottlenecks innovation. By 2026, anticipate a client explosion: mobile-first apps, VR integrations, enterprise tools. Farcaster’s 250,000 monthly active users provide the seedbed.

Regulatory tailwinds add momentum. Europe’s DMA and U. S. antitrust probes target Big Tech silos, creating openings for interoperable social graphs. Farcaster, with its onchain storage, sidesteps these risks. Neynar’s infrastructure pivot aligns perfectly, potentially attracting institutional flows into protocol treasuries or governance tokens down the line.

Long-term value accrues to holders of aligned assets. Neynar may introduce sustainable economics, like fee-sharing hubs or dev grants funded by protocol revenue. Merkle’s exit avoids the founder-token trap, where incentives misalign post-raise. Romero’s transparency builds trust, a scarce commodity in Web3.

Charting Farcaster’s 2026 Trajectory

Looking ahead, Farcaster under Neynar eyes 1 million active users by year-end, fueled by dev onboarding. Metrics to track: wallet growth beyond 100,000 funded, frame adoption rates, and cross-protocol bridges with Lens or CyberConnect. This isn’t hype; it’s measured progress rooted in real utility.

The Farcaster Neynar acquisition exemplifies Web3 maturation. Founders refunding capital, handing reins to specialists, and prioritizing sustainability over scale-at-all-costs. For investors, it’s a buy signal on decentralized social infrastructure. Portfolios resilient to 2026 volatility will overweight protocols proving antifragility now. Farcaster’s reset clears noise, revealing enduring value in user-sovereign networks.