In the bustling arena of Web3 social in 2026, Lens Protocol apps stand out for their uncanny resemblance to Twitter clones. This design choice is no accident. Developers leverage familiarity to lower barriers, drawing in users weary of centralized platforms while quietly building toward richer experiences in gaming, dating, and niche networking. Backed by Aave, trading at $108.48 with a 24-hour gain of and $0.82, Lens harnesses Polygon for NFT-based profiles that grant true ownership over content and connections. What starts as a Twitter-like feed evolves into composable primitives ripe for innovation.

Lens Protocol apps prioritize user-centric design from the outset. Traditional social media demands users rebuild networks on new platforms, a friction point Bluesky grapples with despite 40 million users. Lens sidesteps this through portable NFT profiles, instantly transplanting followers and posts across apps. This decentralized social primitives foundation lets Lenster deliver a seamless Twitter experience, complete with threaded posts and polls, yet every interaction lives on-chain.

The Strategic Mimicry of Lens Twitter Clones

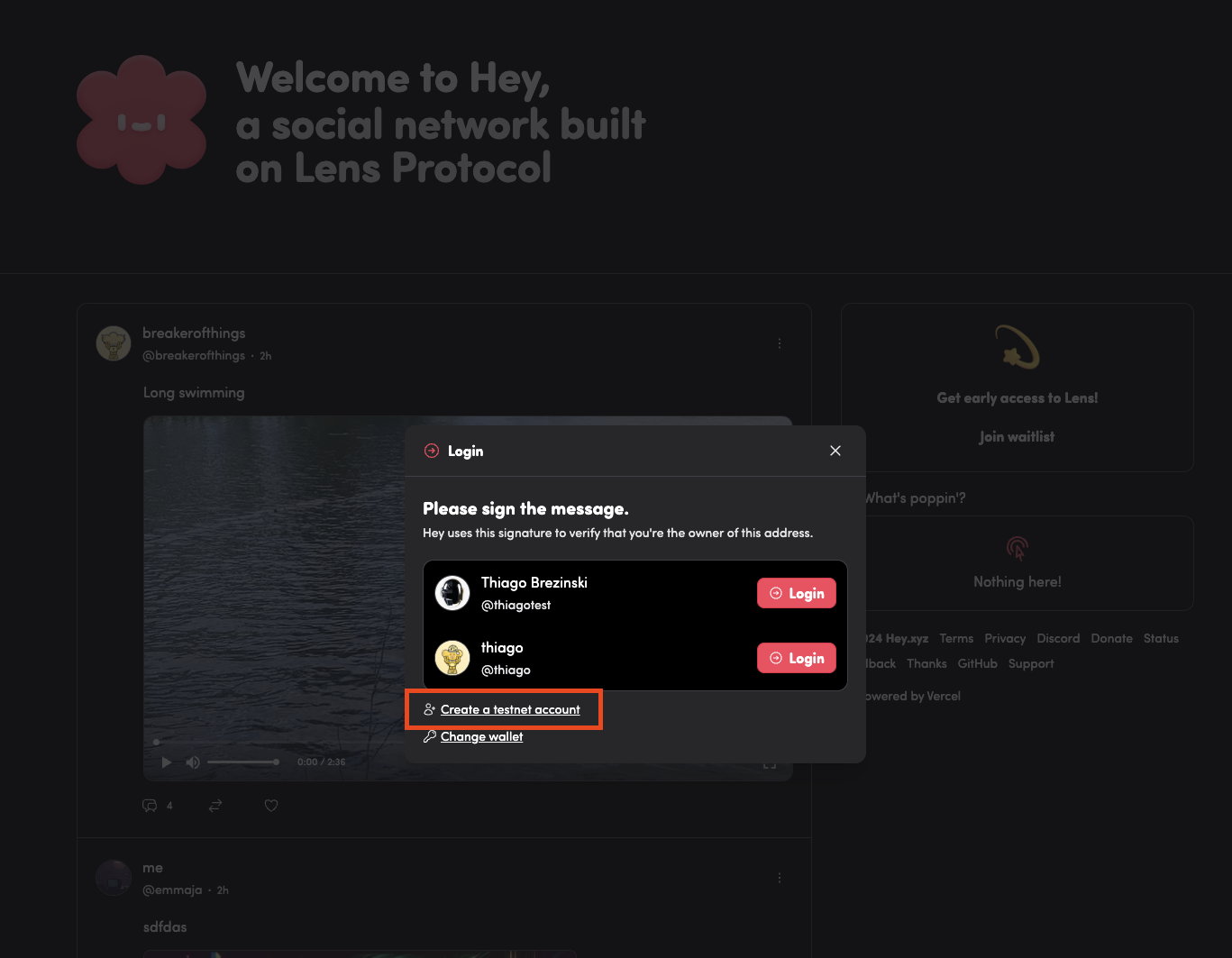

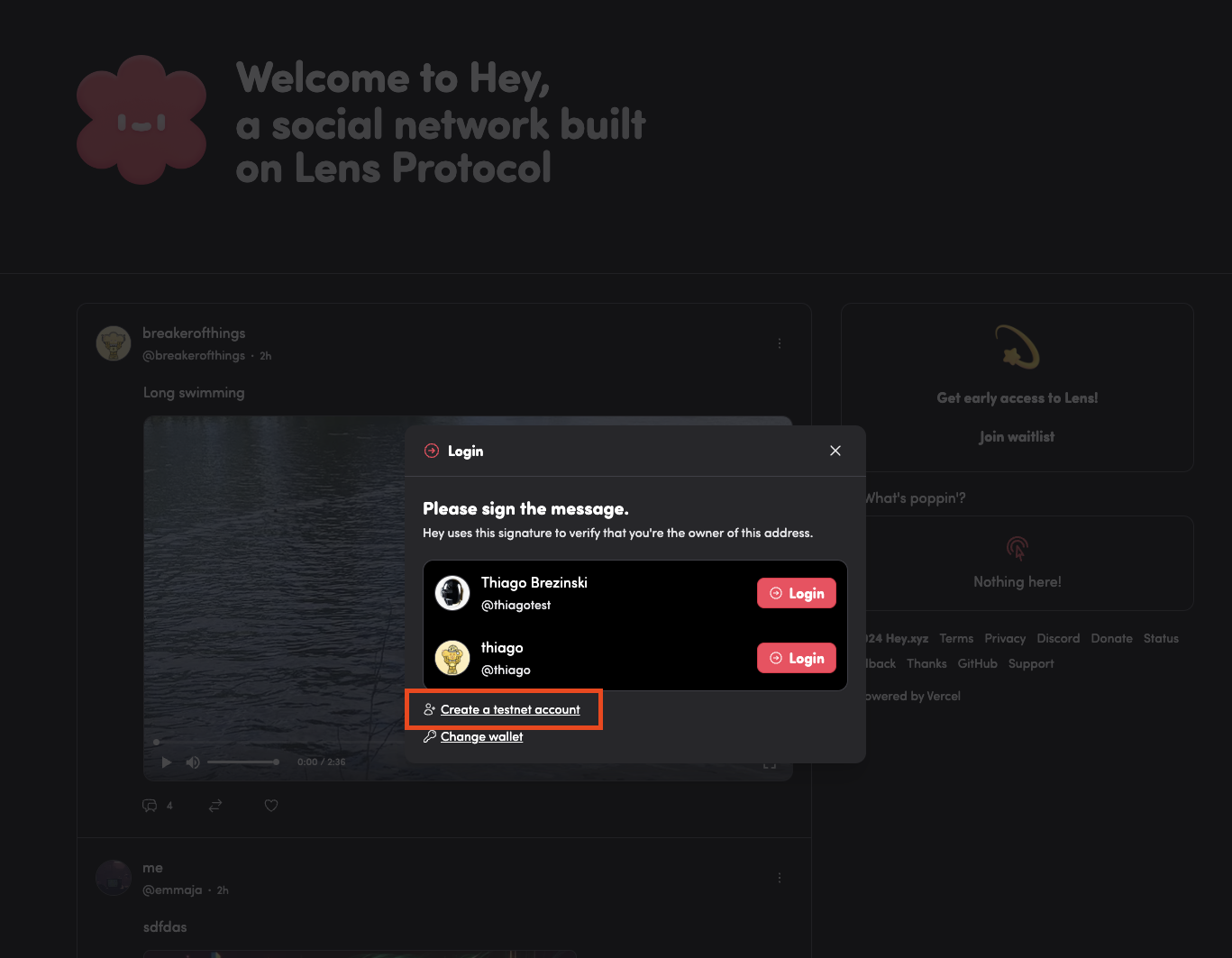

Why mimic Twitter at all? Consumer expectations for apps in 2026 demand pixel-perfect usability, especially in gaming and social realms. Finance apps get a pass on clunky interfaces, but not social ones. Lens Twitter clones like Orb for professional networking and Hey for casual feeds nail this. Orb echoes LinkedIn-Twitter hybrids, fostering Lens professional networking with verifiable credentials tied to NFTs. Hey simplifies discovery, pulling users from X with one-tap follows.

This strategy accelerates adoption. Phaver, a share-to-earn app, blends Instagram vibes with Lens rewards, posting images and earning tokens. Tape apes TikTok shorts, proving short-form video thrives on decentralized rails. Developers report faster user growth; familiar UIs mask the shift to ownership. As a portfolio strategist, I view this as masterful positioning: hook with comfort, retain with utility.

Key Lens Twitter Clones

-

Lenster: Microblogging app mimicking Twitter’s interface for seamless decentralized posting on Lens Protocol.

-

Orb: Professional networking platform enabling connections and profiles via NFT-based identities on Lens.

-

Phaver: Share-to-earn social app rewarding users for content sharing across iOS and Android on Lens.

-

Hey: Curated feeds app delivering personalized content discovery in a Twitter-style format on Lens.

-

Tape: Short-video platform like TikTok for quick clips and viral sharing powered by Lens Protocol.

Composability Fuels Gaming and Dating Potential

Beneath the Twitter facade lies Lens’s modular architecture. Open Actions embed smart contracts directly into posts, enabling one-tap NFT mints, voting, or games. This unlocks Lens gaming apps where players trade assets mid-session, ownership intact across ecosystems. Imagine roguelites with on-chain leaderboards or web-to-app onboarding, aligning with 2026 mobile gaming predictions of seamless monetization.

Dating apps on Lens transform swipes into owned profiles. Matches become composable; a profile NFT carries endorsements, preferences, and even tokenized gifts. Niche networking flourishes too: collectibles communities host embedded auctions, DAOs run polls with real stakes. For more on this, explore how Lens makes engagement transparent. Unlike rigid Twitter, Lens apps remix features, creating hybrids like Bonsai’s AI launchpad fused with social feeds.

From Clones to Category Killers

Lens Twitter clones are trojan horses for deeper disruption. While Farcaster battles for $2.4 billion in Web3 social dominance, Lens’s Polygon efficiency and Aave ties, with AAVE steady at $108.48, position it for scale. Early apps faced hype backlash, labeled NFT-jammed Twitter killers that faltered. Yet 2026 reveals maturity: 30-plus ecosystem projects span Lenstube videos to Phaver earnings.

Resilience defines Lens’s trajectory. Critics once dismissed it as a fleeting NFT fad, but persistent innovation has birthed resilient apps. Lenstube rivals YouTube with owned video NFTs, while emerging Lens gaming apps integrate play-to-earn mechanics directly into social graphs. Developers embed roguelite challenges or multiplayer lobbies via Open Actions, where victories mint collectibles transferable across games. This composability sidesteps siloed ecosystems, a pain point in traditional mobile gaming where assets vanish upon platform shifts.

Lens Dating Protocol: Ownership Meets Serendipity

Dating on Lens reimagines romance through Lens dating protocol primitives. Profiles as NFTs encode preferences, past matches, and social proof, verifiable on-chain. Swipes trigger smart contracts for mutual interests, with tokenized compliments or virtual dates as native features. Niche twists abound: polyamory circles with group endorsements or hobby-based matching for gamers seeking co-op partners. Unlike Tinder’s opaque algorithms, Lens offers transparent, portable chemistry. A match on one app follows to another, preserving history without data lock-in.

Strategic developers blend these with earnings. Picture a dating app where successful dates yield shared NFTs, tradeable or staked for perks. This gamifies connection, aligning with 2026’s hybrid social-gaming expectations. Phaver’s share-to-earn model hints at the playbook: post a date story, earn tokens, build a personal brand. As Aave holds firm at $108.48, up $0.82 in 24 hours, its Lens bet underscores long-term conviction in user-owned social dynamics.

Lens Protocol Apps: Twitter-Like Features with Web3 Twists

| App Name | Twitter-like Feature | Unique Web3 Twist |

|---|---|---|

| Lenster | Feeds and timelines | NFT profiles and content ownership |

| Orb | Professional networking | Credential NFTs |

| Phaver | Social posting with images | Share-to-Earn rewards |

| Hey | Microblogging and conversations | Seamless Lens ecosystem integration |

| Lenstube | Video sharing | Decentralized video hosting and ownership |

| Tape | Short-form video feeds | Embedded smart contract calls and Open Actions |

Niche networking elevates further. Collectors rally around embedded auctions in feeds; writers launch tokenized newsletters with subscriber DAOs. Lens Protocol apps transcend clones by layering financial primitives atop social ones. Farcaster competes fiercely, yet Lens’s Polygon base delivers cheaper, faster transactions, crucial for consumer-scale gaming or real-time dating swipes. Bluesky’s 40 million users highlight demand for alternatives, but without ownership, they risk repeating Twitter’s centralization pitfalls.

Investment Lens: Positioning for 2026 Growth

From a portfolio perspective, Lens embodies steady Web3 maturation. Early volatility gave way to utility-driven adoption, with nearly 30 ecosystem projects proving viability. Stake in AAVE at $108.48 not just for DeFi yields, but as a conduit to SocialFi expansion. Diversify via Lens-native tokens from Phaver or emerging gaming dApps, balancing hype with fundamentals. Watch for Lens Chain’s all-in-one evolution, fusing social and financial rails.

Challenges persist: user education on wallets and gas fees, though Polygon mitigates this. Regulatory scrutiny on NFT profiles looms, demanding compliant designs. Still, Lens Twitter clones pave the optimal path: familiarity breeds mass onboarding, composability sparks retention. By 2026, expect category killers in gaming hybrids, dating marketplaces, and vertical networks dominating niches Twitter ignores.

Developers, build boldly on these decentralized social primitives. Investors, allocate thoughtfully to protocols blending usability with ownership. Lens Protocol apps signal Web3 social’s pivot from mimicry to mastery, where every profile unlocks endless potential.