In the ever-shifting terrain of Web3, where protocols rise and pivot with the speed of blockchain confirmations, the departure of Farcaster’s co-founders Dan Romero and Varun Srinivasan marks a pivotal moment. After steering decentralized social toward mainstream traction, they’ve now turned their gaze to Tempo, a stablecoin powerhouse. This Farcaster founders Tempo transition, hot on the heels of Neynar’s acquisition, signals more than personnel shuffle; it underscores a broader realignment from social experimentation to payment infrastructure as the true north for crypto adoption in 2026.

Farcaster, once a beacon for onchain social with its frames and casts, had carved a niche amid Twitter’s tumble and Threads’ rise. Romero and Srinivasan built it into a developer darling, emphasizing user-owned data and seamless wallet integration. Yet, as decentralized social future grapples with monetization hurdles and retention woes, the founders’ exit feels less like abandonment and more like strategic evolution.

Neynar’s Bold Bet on Farcaster Infrastructure

The Farcaster Neynar acquisition in January 2026 wasn’t a fire sale but a symbiotic merger. Neynar, already deep in Farcaster’s tooling ecosystem, scooped up the protocol to supercharge developer kits and APIs. Post-deal, Farcaster hums under new stewardship, doubling down on scalability fixes and frame innovations that power viral mini-apps. Romero and Srinivasan stepping away clears the deck for Neynar’s infrastructure push, potentially accelerating Farcaster’s wallet pivot toward embedded finance hooks. This handover preserves Farcaster’s ethos while injecting fresh capital and focus, vital as decentralized social scales beyond niche crypto Twitter clones.

Critics might decry it as founders cashing out, but balance the ledger: Farcaster’s active users hovered steady, yet revenue streams lagged. Neynar’s expertise in client-side indexing and hub optimizations positions the protocol for longevity, free from the founders’ divided attention.

Tempo: Stablecoins as the Payments Backbone

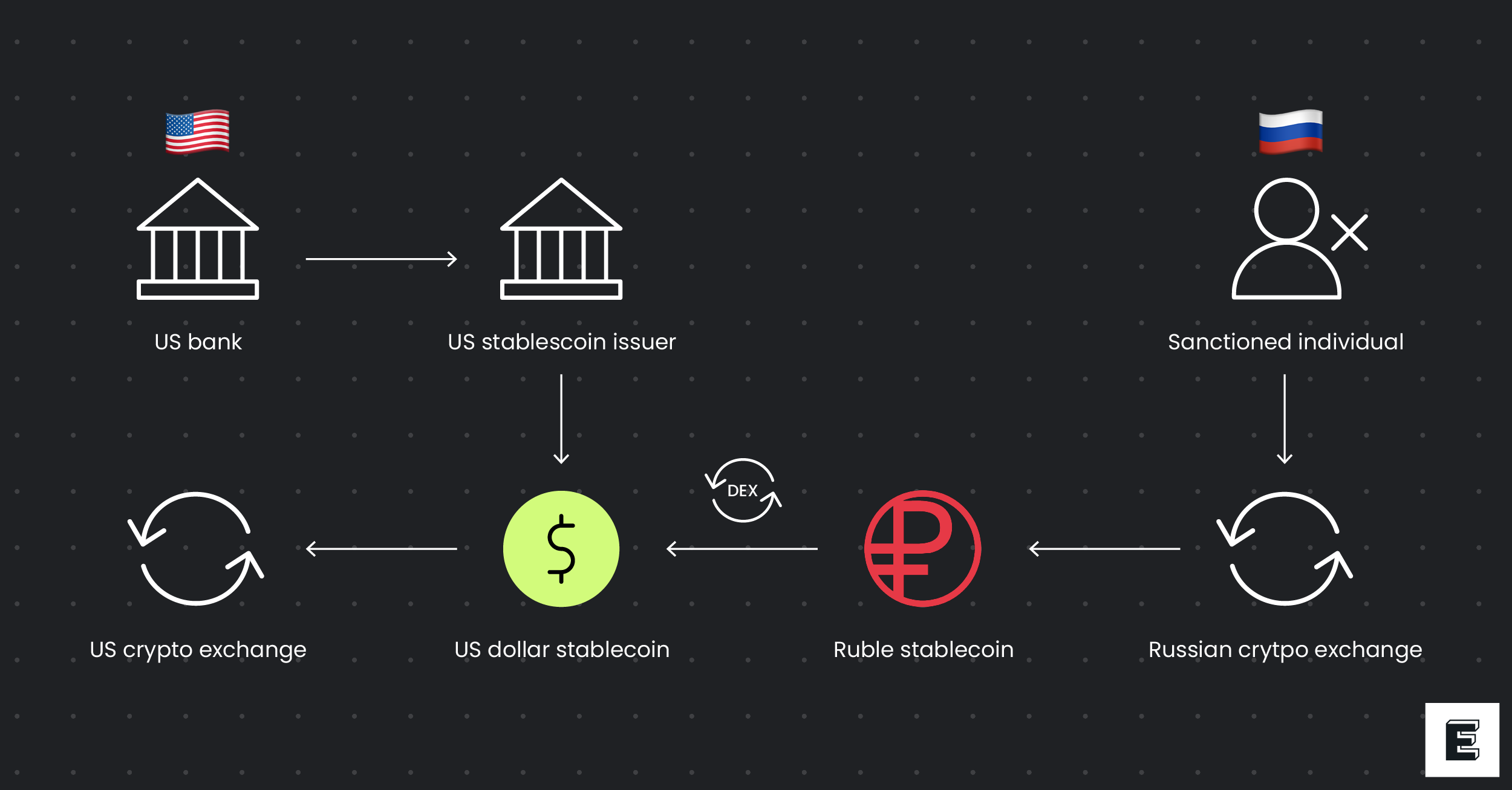

Enter Tempo, the Layer 1 blockchain incubated by Stripe and Paradigm, laser-focused on stablecoin rails. With a whopping $500 million Series A at $5 billion valuation in October 2025, Tempo isn’t playing small. It promises fast, inexpensive, transparent global payments, leveraging stablecoins to undercut legacy rails like Swift. Romero and Varun Srinivasan Farcaster roots in social graph tech bring unique sauce: imagine social feeds funding peer-to-peer transfers or frames triggering instant settlements. Their arrival bolsters Tempo’s bid to weave stablecoins into everyday commerce, a macro trend where crypto sheds speculative skin for utility.

Dan Romero Tempo involvement hints at cross-pollination. Farcaster’s wallet-centric design, honed for seamless sign-ins, aligns perfectly with Tempo’s low-friction tx goals. Srinivasan, the engineering mind behind Farcaster’s Hubs, could turbocharge Tempo’s throughput, targeting sub-second finality for stablecoin swaps. This isn’t desertion; it’s founders chasing scalable impact where social met infrastructure faltered.

Decentralized Social’s Fork in the Road

As 2026 unfolds, this pivot illuminates fault lines in decentralized social. Farcaster thrives under Neynar, but the founders’ leap to Tempo spotlights payments as crypto’s killer app. Social protocols struggle with virality sans centralized algorithms, while stablecoins clock trillions in volume. Expect Farcaster to evolve into a social layer atop payment primitives, perhaps integrating Tempo rails for tipping or DAOs. The Farcaster wallet pivot 2026 gains momentum here, blending identity with transactability. Investors take note: talent flows to where margins hide, and right now, that’s stablecoin plumbing fueling global flows.

Yet balance tempers optimism. Tempo faces regulatory thickets and competition from Solana’s Pay and Base’s onramps. Farcaster risks stagnation if Neynar’s tooling doesn’t spark killer apps. Still, Romero and Srinivasan’s track record – from Warpcast’s launch to Farcaster’s Optimism migration – lends credibility. Their Tempo tenure could redefine how social and finance entwine, pushing decentralized networks toward hybrid models that endure.

Looking ahead, the interplay between Farcaster’s social scaffolding and Tempo’s payment engine could birth next-gen apps where casts fundraise via stablecoin drips or frames settle microtransactions onchain. This decentralized social future hinges on such convergences, where protocols specialize rather than do-all. Neynar’s Farcaster stewardship might yield polished frames that plug into Tempo’s rails, creating frictionless social commerce loops.

Talent Migration Signals Crypto’s Maturation

Crypto builders like Romero and Srinivasan embody the sector’s maturation. From social moonshots to stablecoin bedrock, their arc mirrors a portfolio rebalance: trimming volatile social bets for steady payment yields. This Farcaster founders Tempo move echoes past shifts, like Coinbase alumni fueling DeFi or Twitter vets igniting Web3 social. It validates stablecoins as crypto’s ballast amid volatility, with Tempo’s $5 billion valuation underscoring investor appetite for rails over hype.

Key Takeaways

-

Farcaster-Neynar Synergies: Neynar’s acquisition enhances decentralized social infrastructure with advanced developer tooling.

-

Tempo’s Stablecoin Edge: Founders Dan Romero and Varun Srinivasan join Stripe/Paradigm-backed Tempo, leveraging $5B valuation for fast global payments.

-

Social vs Payments Risks: Shift from social protocols to payments exposes regulatory hurdles and competition in volatile crypto markets.

-

Hybrid Models for 2026: Founders’ move signals rise of social-finance integrations in decentralized networks.

For developers eyeing Farcaster’s stack, Neynar’s acquisition fortifies the foundation. Enhanced hubs and indexing mean smoother dapp builds, while the Farcaster wallet pivot 2026 evolves signers into spenders. Tempo, meanwhile, recruits talent primed for scale: Romero’s product instincts and Srinivasan’s infra chops could shave latency from stablecoin flows, targeting Visa-level speeds at pennies per pop.

Investors scanning the horizon should weigh this bifurcation. Decentralized social, post-founders, banks on Neynar’s execution to monetize via premium APIs or frame marketplaces. Tempo, supercharged, eyes enterprise adoption where remittances and payroll crave stablecoin certainty. Crossovers loom large: Farcaster identities verifying Tempo wallets, or casts syndicating funding rounds settled instantly. Such integrations could propel both, blending social virality with financial gravity.

Risks persist, of course. Regulatory scrutiny dogs stablecoins, from reserve audits to cross-border chokepoints. Farcaster must fend off Lens Protocol’s NFT-social fusion or Friend. tech’s tokenized clout. Yet the founders’ pedigree – bootstrapping Farcaster to millions of frames without VC fanfare – tilts odds favorably. Their Tempo pivot isn’t flight; it’s fusion, channeling social learnings into payments that loop back to enrich protocols like Farcaster.

As Web3 crests into 2026, this chapter recasts decentralized social not as rival to centralized giants, but as extensible layer over robust primitives. Neynar-tuned Farcaster provides the graph; Tempo-forged stablecoins, the liquidity. Romero and Srinivasan, now at the nexus, stand poised to wire them together. Watch for hybrid protocols where your feed funds your future, proving crypto’s endurance lies in purposeful pivots.