In a seismic shift for decentralized social networks, Neynar has acquired Farcaster in January 2026, prompting Merkle Manufactory to return its full $180M in venture capital to backers. This Neynar Farcaster acquisition 2026 marks not just a handover but a pivotal realignment toward developer-centric tools and wallet functionalities, signaling broader changes in Web3 social dynamics.

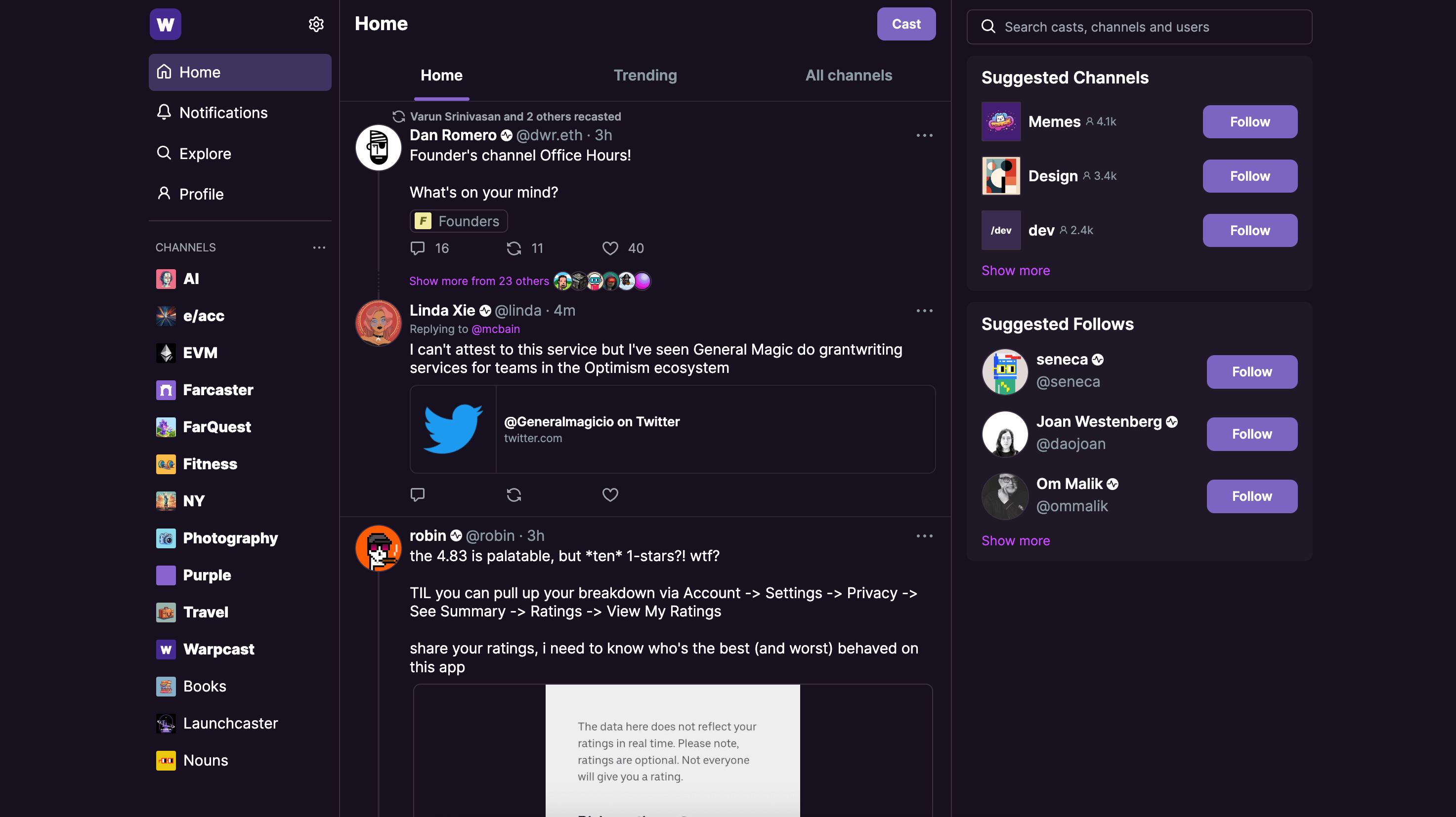

Founder Dan Romero’s confirmation lit up feeds across crypto Twitter and Farcaster itself. After years of building what promised to be the Twitter killer on blockchain, Farcaster faced headwinds in scaling its social-first model. User growth plateaued, monetization lagged, and competition from centralized giants intensified. Enter Neynar, the infrastructure powerhouse already deeply embedded in Farcaster’s ecosystem through APIs and developer kits.

Neynar Steps In: Infrastructure Muscle Meets Social Protocol

Neynar’s move isn’t a fire sale; it’s a strategic fusion. As Farcaster’s top infrastructure provider, Neynar has powered much of the protocol’s backend, from frame tech to app integrations. Post-acquisition, expect accelerated developer tools, smoother wallet onboarding, and tighter synergies with on-chain actions. Farcaster Neynar sale timeline unfolded rapidly: strategic pivot announced late 2025, acquisition sealed early 2026. With 250,000 monthly active users and over 100,000 funded wallets, the protocol boasts solid traction that Neynar can amplify.

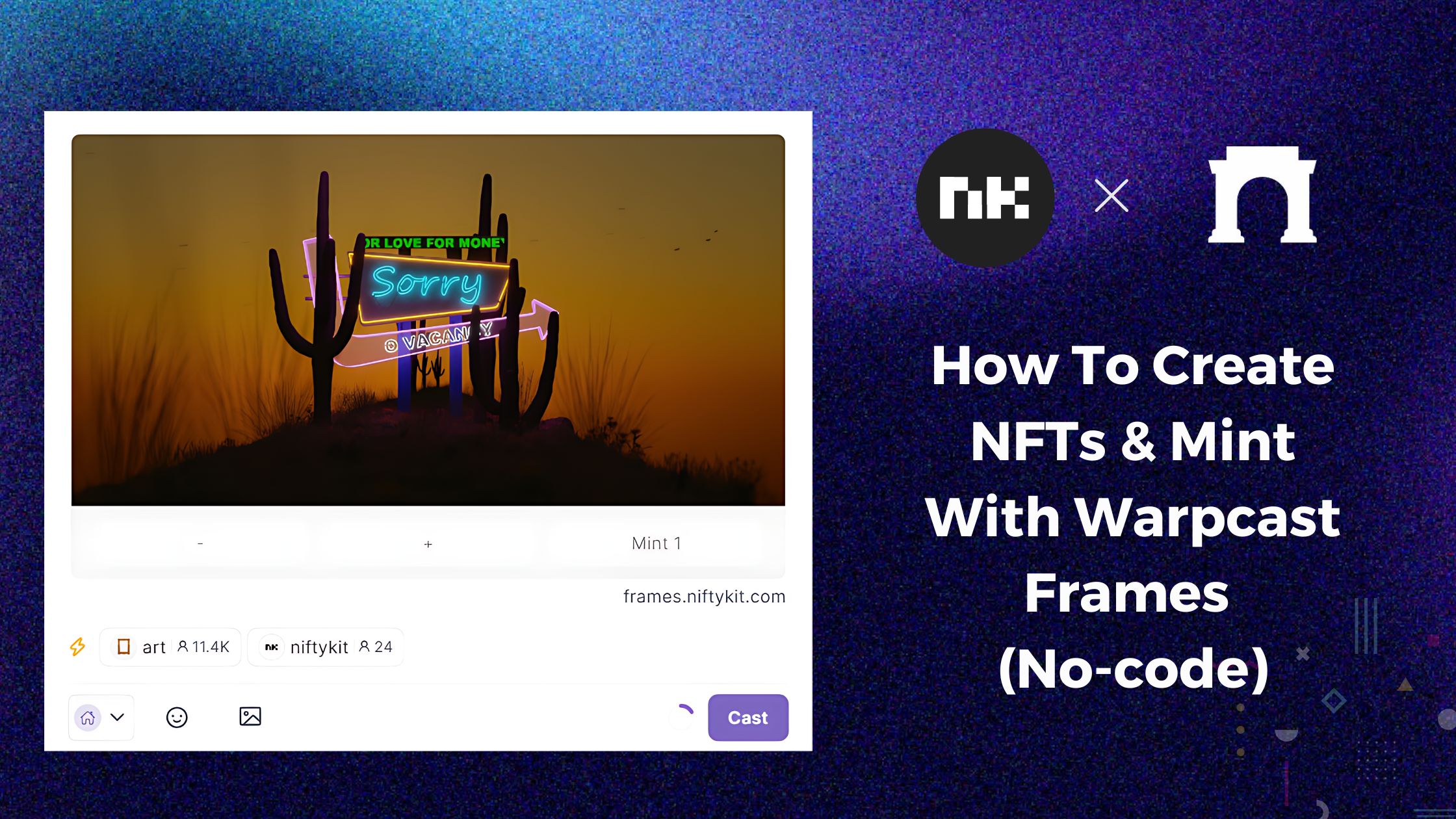

This isn’t shutdown territory, despite whispers of Farcaster Merkle Manufactory shutdown. The protocol hums on, decentralized by design. Neynar’s vision leans into a wallet-first ethos, where social features orbit around seamless crypto interactions. Think in-app swaps, NFT showcases, and DeFi plays without leaving the feed – a far cry from pure social networking.

From Social-First Struggles to Wallet-First Promise

December 2025’s pivot was the precursor. Farcaster ditched broad social ambitions for focused wallet innovations after growth stalled. Sustainable revenue proved elusive; ad models clashed with decentralization ethos, and virality didn’t convert to sticky engagement like legacy platforms. Data shows monthly actives hovered steadily, but conversion to powered wallets lagged until wallet-first tweaks boosted them past 100k.

Neynar, battle-tested in protocol scaling, brings expertise to bridge this gap. Their infrastructure has already handled millions of API calls daily for Farcaster apps. Acquisition terms remain under wraps, but the real headline is Merkle Manufactory’s unprecedented step: refunding every dollar of its $180M raise. Check the details from their epic funding round here, backed by Paradigm and a16z in 2025 hype.

$180M VC Return: A Rare Act of Capital Recycling

Merkle Manufactory’s decision flips the VC script. Over five years, they scooped $180M to fuel Farcaster’s rise. Now, post-acquisition, that capital flows back intact to LPs. It’s a win for investors facing protocol transitions, underscoring Merkle’s conviction in Neynar’s stewardship. Farcaster $180M VC return isn’t failure; it’s maturity in a nascent space where moonshots often fizzle.

Investors get their capital back without the usual dilution or markdowns that plague protocol handovers. In a sector littered with zombie chains and rug pulls, this Farcaster $180M VC return sets a benchmark for accountability. LPs can redeploy funds into Neynar’s expanded vision or elsewhere, while the protocol sidesteps the baggage of overpromised social dominance.

Developer Dawn: Neynar’s Playbook for Farcaster 2.0

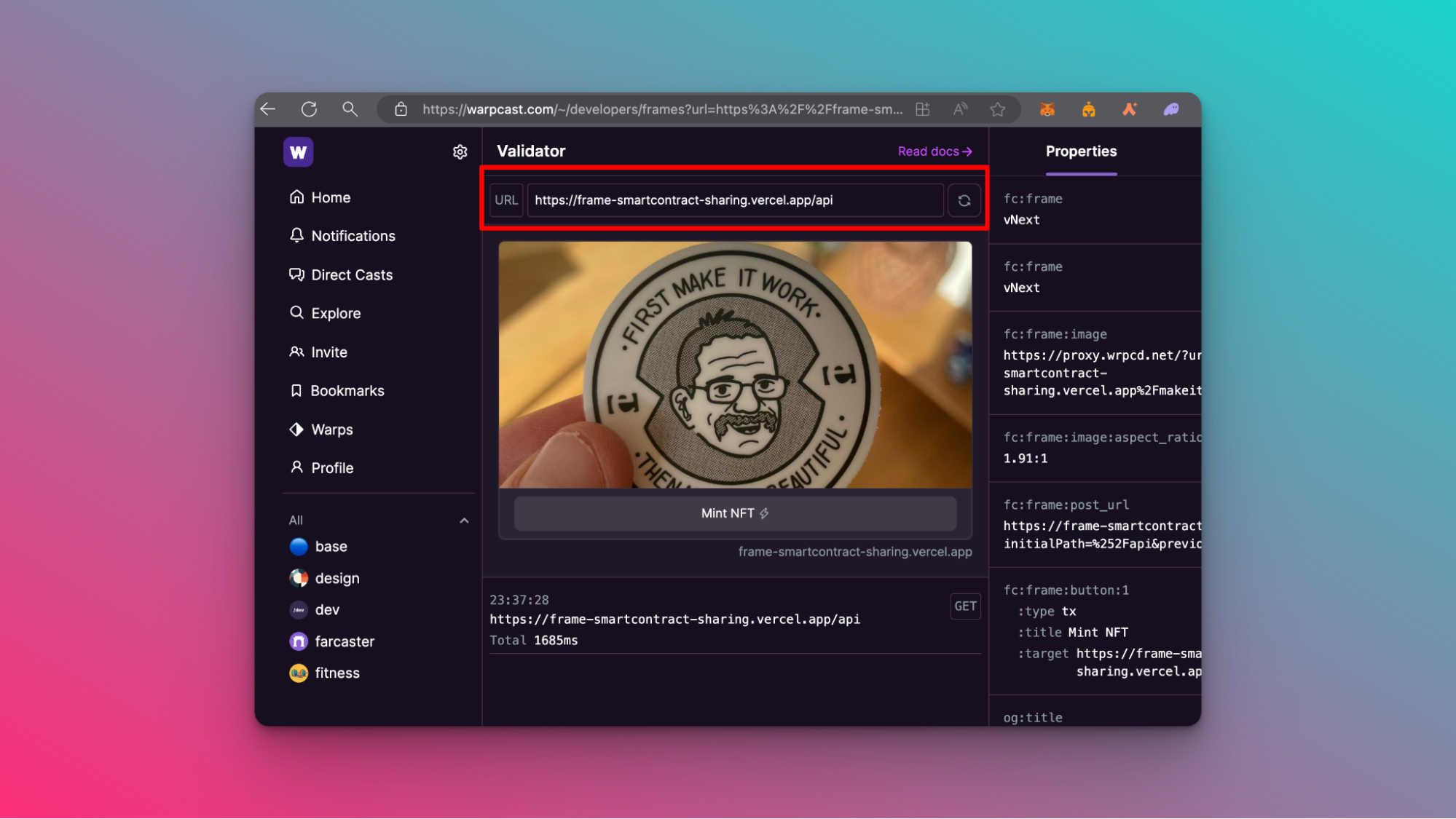

Zoom in on Neynar’s strengths: they’ve been the unsung hero of Farcaster’s stack, processing frame renders, cast indexing, and wallet hooks at scale. Daily API traffic? Millions of calls from hundreds of apps. Acquisition supercharges this. Expect SDKs that slash integration time from weeks to hours, embedded wallets that feel native, and on-ramp tools rivaling centralized exchanges. Farcaster’s decentralized social Farcaster future pivots to a hub for Web3 apps, where social is the entry point to everything else.

Numbers back the momentum. Holding steady at 250,000 monthly active users, Farcaster outpaces many Layer 2 social experiments. Those 100,000 and funded wallets signal real on-chain skin in the game – not just lurkers, but traders, collectors, and builders transacting daily. Neynar’s infrastructure edge could double that in months, especially with wallet-first features like one-click airdrop claims or social DeFi dashboards.

Key Post-Acquisition Upgrades

-

Faster API Scaling – Neynar’s infrastructure expertise turbocharges Farcaster APIs for handling millions of requests with sub-second latency.

-

Seamless Wallet Integrations – Effortless in-app wallet connections via WalletConnect, aligning with Farcaster’s wallet-first pivot.

-

Enhanced Frame Dev Tools – Upgraded SDKs and docs for building interactive Frames, speeding up Web3 social apps.

-

Boosted App Ecosystem Grants – Expanded funding pool to supercharge Farcaster’s 250K+ MAU app developers.

-

On-Chain Social Analytics Dashboard – Real-time insights into 100K+ funded wallets and social graphs.

Community buzz underscores the optimism. Frames – Farcaster’s killer embed tech – already power viral apps like Warpcast games and prediction markets. Neynar plans to open-source more internals, drawing indie devs hungry for blockchain-native UIs. This isn’t dilution of the original dream; it’s evolution. Social-first hit walls, but wallet-first unlocks trillion-dollar primitives: identity, payments, ownership.

Web3 Social Shakeup: Beyond Farcaster

Ripples extend industry-wide. Neynar Farcaster acquisition 2026 exposes fault lines in decentralized social. Protocols like Lens and CyberConnect grapple similar growth pains: flashy launches, then retention cliffs. Farcaster Neynar sale timeline proves bold pivots pay off when backed by operators who eat their own dogfood. Merkle Manufactory’s exit refunds erase sunk-cost biases, letting fresh capital chase utility over hype.

Look at traction metrics. Farcaster’s daily casts hit 1M and pre-acquisition, with frames driving 40% engagement spikes per on-chain report. Neynar’s tooling could juice that to Twitter-scale virality, minus censorship. Investors eyeing decentralized social Farcaster future should note: this deal validates infrastructure moats over consumer apps. Neynar wasn’t buying a userbase; they bought a greased rail for Web3’s social layer.

Challenges linger. Wallet UX remains clunky for normies, gas fees nibble edges, and Ethereum’s congestion tests resolve. Yet Neynar’s track record – powering 80% of Farcaster apps pre-deal – positions them to iterate fast. Grants for builder bounties, already flowing, target exactly these pain points.

The shift reframes Web3 social as composable Lego: protocols stack, not compete. Farcaster slots into ecosystems like Base or Optimism, feeding data to AI agents or DAOs. Merkle’s refund? A signal to VCs: bet on primitives, not platforms. Neynar proves you can sunset one era while igniting the next.

Track the Farcaster Neynar sale timeline closely – from pivot to payoff in under two months. With 250k MAUs as bedrock, Neynar-Farcaster hybrid eyes 1M users by mid-2026. Developers, sharpen your kits; users, fund those wallets. Decentralized social isn’t dying – it’s wallet-wired, ready to onboard the next billion on-chain actions.