In the ever-evolving world of decentralized social networks, few moves carry the weight of Neynar’s acquisition of Farcaster. This farcaster neynar acquisition not only reshapes the protocol’s trajectory but also introduces a rare farcaster vc refund 180m that’s turning heads across Web3. Merkle Manufactory, Farcaster’s parent company, plans to hand back the full $180 million raised from venture capitalists over five years, while assuring the community that the protocol lives on under new stewardship. It’s a bold statement amid a decentralized social protocol shift, signaling a pivot from aggressive growth to sustainable infrastructure.

This isn’t your typical crypto fire sale. Co-founder Dan Romero, a Coinbase alum, took to social channels to clarify: Farcaster isn’t shutting down, rumors of founders misusing funds are baseless, and Neynar’s developer-focused ethos aligns perfectly with the protocol’s open-source roots. With 250,000 monthly active users and over 100,000 funded wallets as of late 2025, Farcaster boasts real traction in a crowded SocialFi landscape.

Dissecting the Deal: From Merkle to Neynar

Neynar, known for its robust Web3 developer tools, steps in as Farcaster’s new guardian. Founders Dan Romero and Varun Srinivasan are farcaster founders step back, handing the reins after navigating controversies, user activity dips, and what insiders call “costly errors. ” The acquisition comes hot on the heels of Lens Protocol’s pivot to Mask Network, underscoring a broader reset in decentralized social media.

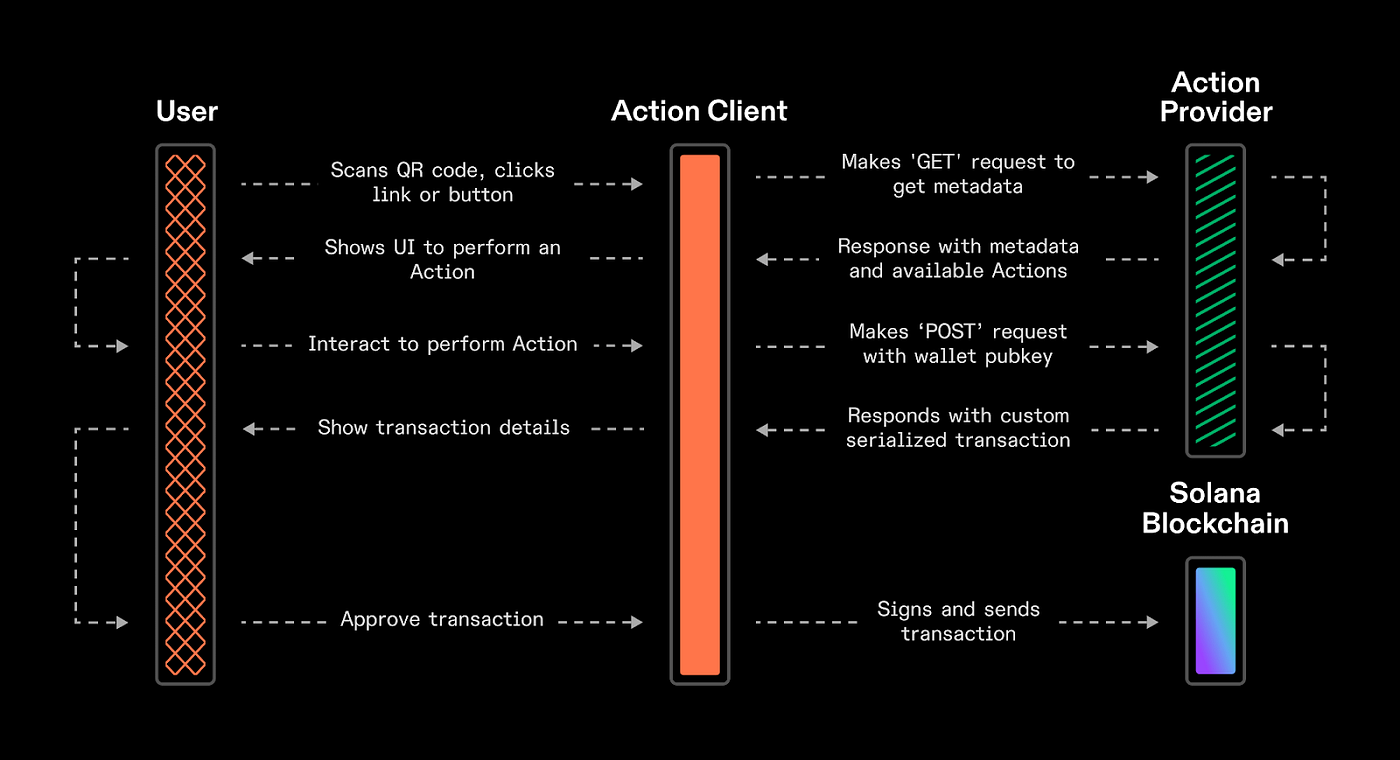

Why now? Farcaster’s hybrid model – onchain identities with offchain storage – promised scalability but faced scalability hurdles and competition from centralized giants dipping into Web3. Neynar’s infrastructure prowess could unlock that potential, emphasizing APIs and tools over consumer apps. Romero’s post emphasized continuity: the protocol remains active, frames and channels persist, and developers keep building.

The Unprecedented $180M Investor Repayment

Returning $180 million intact is unheard of in venture-backed crypto. Merkle Manufactory raised this war chest from top-tier backers, including Balaji Srinivasan, who publicly endorsed the move. Balaji’s nod quells speculation, framing it as a principled exit rather than distress.

Consider the optics: in a sector rife with rug pulls and locked liquidity, this refund restores faith. It’s pragmatic too – founders avoid dilution under new ownership and sidestep regulatory scrutiny. Romero debunked wild claims, like using funds for personal purchases, positioning the handover as a clean slate. For investors, it’s capital preservation in a bearish SocialFi cycle; for the ecosystem, proof that decentralization can self-correct without drama.

Farcaster’s Path Forward Under Neynar

Expect a neynar farcaster future laser-focused on devs. Neynar’s track record with client libraries and scalable infra positions Farcaster for explosive app growth. Gone are the days of chasing viral DAUs; instead, think embedded social layers in DeFi, gaming, and beyond.

Current metrics paint a resilient picture: those 250,000 MAUs aren’t vanity stats – they’re engaged users powering casts, frames, and Warwick channels. Neynar’s shift mirrors industry maturation, where protocols thrive as utilities, not platforms. Developers gain polished tools, wallets integrate seamlessly, and the onchain social graph deepens.

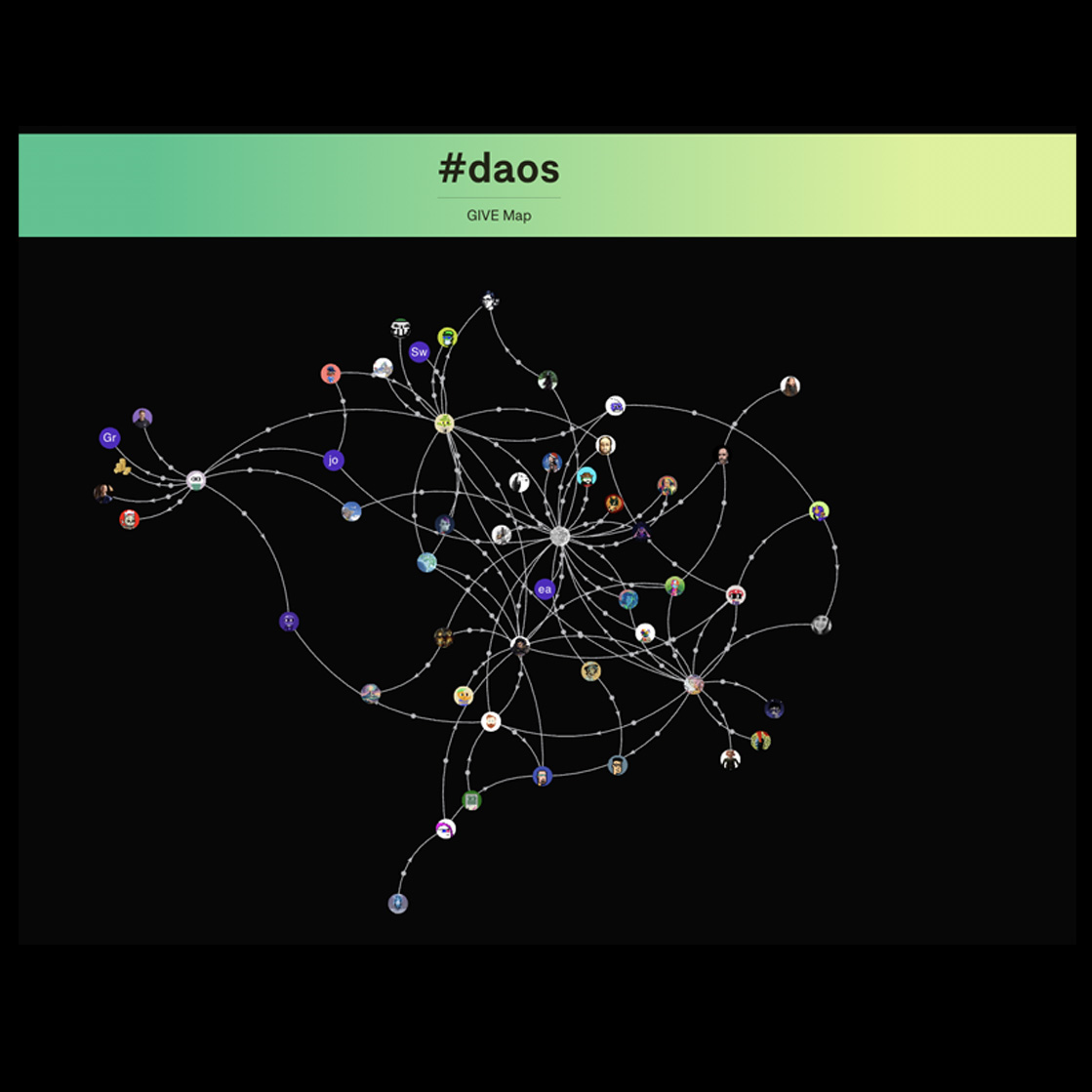

That onchain social graph – think programmable identities tied to Ethereum addresses – sets Farcaster apart, enabling trustless interactions that centralized apps can’t match. Neynar’s acquisition accelerates this, potentially birthing a new wave of SocialFi primitives.

Wider Ripples: Decentralized Social’s Reckoning

This decentralized social protocol shift isn’t isolated. Lens Protocol’s handoff to Mask Network echoes the same theme: protocols shedding company baggage to focus on core tech. Farcaster’s user base, while dipping from peaks, holds steady at 250,000 MAUs, a testament to sticky features like frames – those interactive mini-apps embedded in casts. Neynar inherits a battle-tested stack, primed for embedding in wallets like Rabby or DeFi dashboards.

Critics point to declining activity and founder exits as red flags, but data tells a different story. Over 100,000 funded wallets signal real economic activity, not just lurkers. The $180 million refund, meanwhile, flips the script on VC dependency. In a space where founders often cling to treasury hoards, Merkle’s move prioritizes protocol purity over empire-building. It’s a masterclass in aligned incentives, where capital returns pave the way for organic growth.

Neynar’s Dev-Centric Farcaster Wins

-

Enhanced APIs for app builders: Neynar’s robust endpoints simplify access to casts, follows, and user data, accelerating dApp development on Farcaster.

-

Scalable storage solutions: Optimized Hubs handle surging data from 250K+ MAUs, ensuring reliable, decentralized storage without bottlenecks.

-

Seamless wallet integrations: Plug-and-play support for wallets like Coinbase Wallet enables frictionless onchain sign-ins and transactions.

-

Expanded Frames & Channels tooling: Advanced tools for interactive Frames and topic-based Channels boost engaging, viral social apps.

-

Deeper onchain social graph utilities: Powerful queries unlock insights into follows, casts, and networks for sophisticated analytics.

For everyday users, little changes on the surface. Cast your thoughts, join channels, frame up interactions – all persist. But under the hood, Neynar’s infra upgrades promise snappier experiences, fewer gas wars during hype cycles. Developers, rejoice: expect SDKs that rival Web2 ease, letting you layer social onto any dApp without reinventing the wheel.

Lessons for Web3 Builders

Zoom out, and this saga offers pragmatic wisdom. First, hybrid models rule: Farcaster’s onchain IDs with Optimism storage dodged Ethereum’s bloat while keeping sovereignty intact. Second, founder transitions needn’t spell doom – transparency via refunds builds lasting cred. Third, bet on infrastructure over apps; Neynar proves tooling trumps user farms for longevity.

Balaji Srinivasan’s backing underscores investor savvy: cash back now beats illiquid tokens tomorrow. As SocialFi resets, watch for copycats. Protocols like Farcaster thrive by serving devs, not chasing TikTok virality. Neynar’s playbook – acquire, refund, refocus – could redefine DeSoc sustainability.

Stepping back from the noise, this acquisition fortifies Farcaster’s moat. With Neynar’s resources, expect integrations that weave social into everyday Web3 life: DeFi yield shares via casts, NFT drops in channels, governance via frames. The 250,000-strong community evolves from spectators to co-creators, fueling a more resilient network. In decentralized social’s marathon, this pivot marks not an end, but a sharper turn toward enduring value.